BVN Code Check

The Bank Verification Number (BVN) is a unique 11-digit number that is used to verify the identity of bank customers in Nigeria. It was introduced by the Central Bank of Nigeria (CBN) in 2014 as part of a drive to reduce fraud and improve the security of the Nigerian banking system. The BVN is linked to a customer's biometric data, such as their fingerprints and facial image, and is stored in a central database. This makes it very difficult for fraudsters to impersonate customers or to create fake accounts.BVN code checks are used to verify the identity of customers when they are opening new bank accounts, applying for loans, or making large transactions. They can also be used to track down fraudsters and to recover stolen funds. BVN code checks are a valuable tool for banks and other financial institutions in Nigeria, and they have helped to make the Nigerian banking system more secure and efficient.In addition to its use in the banking sector, the BVN is also used by other government agencies, such as the Nigerian Immigration Service and the Federal Road Safety Corps. This helps to ensure that the BVN is a truly unique identifier for all Nigerians.

BVN Code Check

The Bank Verification Number (BVN) is a unique 11-digit number that is used to verify the identity of bank customers in Nigeria. It was introduced by the Central Bank of Nigeria (CBN) in 2014 as part of a drive to reduce fraud and improve the security of the Nigerian banking system. The BVN is linked to a customer's biometric data, such as their fingerprints and facial image, and is stored in a central database. This makes it very difficult for fraudsters to impersonate customers or to create fake accounts.

- Unique identifier

- Security measure

- Fraud prevention

- Account verification

- Biometric linkage

- Government agency use

BVN code checks are used to verify the identity of customers when they are opening new bank accounts, applying for loans, or making large transactions. They can also be used to track down fraudsters and to recover stolen funds. BVN code checks are a valuable tool for banks and other financial institutions in Nigeria, and they have helped to make the Nigerian banking system more secure and efficient.

In addition to its use in the banking sector, the BVN is also used by other government agencies, such as the Nigerian Immigration Service and the Federal Road Safety Corps. This helps to ensure that the BVN is a truly unique identifier for all Nigerians.

Unique identifier

A unique identifier is a number or code that is used to identify a particular person or thing. It is unique in the sense that no two people or things can have the same unique identifier. Unique identifiers are used in a variety of applications, such as social security numbers, employee ID numbers, and bank account numbers.In the context of BVN code checks, the BVN is a unique identifier that is used to verify the identity of bank customers in Nigeria. It is a unique 11-digit number that is linked to a customer's biometric data, such as their fingerprints and facial image. This makes it very difficult for fraudsters to impersonate customers or to create fake accounts.

BVN code checks are used to verify the identity of customers when they are opening new bank accounts, applying for loans, or making large transactions. They can also be used to track down fraudsters and to recover stolen funds. BVN code checks are a valuable tool for banks and other financial institutions in Nigeria, and they have helped to make the Nigerian banking system more secure and efficient.

In addition to its use in the banking sector, the BVN is also used by other government agencies, such as the Nigerian Immigration Service and the Federal Road Safety Corps. This helps to ensure that the BVN is a truly unique identifier for all Nigerians.

Security measure

A security measure is a procedure or device that is used to protect something from harm or danger. In the context of BVN code checks, security measures are used to protect customers from fraud and identity theft. BVN code checks are a valuable tool for banks and other financial institutions in Nigeria, and they have helped to make the Nigerian banking system more secure and efficient.

- Unique identifier

The BVN is a unique 11-digit number that is linked to a customer's biometric data, such as their fingerprints and facial image. This makes it very difficult for fraudsters to impersonate customers or to create fake accounts.

- Biometric verification

BVN code checks use biometric verification to ensure that the person presenting the BVN is the same person who is linked to the account. This is done by comparing the fingerprints and facial image of the person presenting the BVN to the fingerprints and facial image that are stored in the central database.

- Two-factor authentication

BVN code checks often use two-factor authentication to add an extra layer of security. This means that customers are required to provide two pieces of information when they are accessing their account, such as their BVN and a password. This makes it more difficult for fraudsters to gain access to customer accounts, even if they have stolen their BVN.

- Transaction monitoring

Banks and other financial institutions use transaction monitoring to identify and flag suspicious transactions. This can help to prevent fraud and identity theft, as it allows banks to take action to protect their customers.

BVN code checks are a vital part of the security measures that are used to protect customers from fraud and identity theft. By using BVN code checks, banks and other financial institutions can help to keep their customers' money safe and secure.

Fraud prevention

Fraud prevention is a critical component of the financial industry, and BVN code checks are a valuable tool in the fight against fraud. By verifying the identity of customers, BVN code checks can help to prevent fraudsters from opening new accounts, applying for loans, or making large transactions in the name of another person.

One of the most common types of fraud is identity theft, which occurs when someone steals another person's personal information, such as their name, Social Security number, or bank account number. This information can then be used to open new accounts, apply for loans, or make fraudulent purchases. BVN code checks can help to prevent identity theft by verifying that the person presenting the BVN is the same person who is linked to the account. This is done by comparing the fingerprints and facial image of the person presenting the BVN to the fingerprints and facial image that are stored in the central database.

BVN code checks can also help to prevent fraud by flagging suspicious transactions. For example, if a customer attempts to make a large transaction from a location that is not their usual location, the bank may flag the transaction for review. This can help to prevent fraudsters from using stolen BVN numbers to make unauthorized purchases.

BVN code checks are a valuable tool in the fight against fraud. By verifying the identity of customers and flagging suspicious transactions, BVN code checks can help to protect banks and other financial institutions from financial losses. They can also help to protect customers from identity theft and other types of fraud.

Account verification

Account verification is the process of confirming the identity of a customer who is opening a new bank account. This is important to prevent fraud and to ensure that the customer is who they say they are. There are a number of different ways to verify a customer's identity, including checking their ID, verifying their address, and running a credit check.BVN code checks are a type of account verification that is used in Nigeria. The BVN is a unique 11-digit number that is linked to a customer's biometric data, such as their fingerprints and facial image. When a customer opens a new bank account, they are required to provide their BVN. The bank will then compare the customer's BVN to the BVN that is stored in the central database. If the two BVN numbers match, then the customer's identity is verified.

BVN code checks are a valuable tool for banks and other financial institutions in Nigeria. They help to prevent fraud and to ensure that customers are who they say they are. BVN code checks are also a convenient way for customers to verify their identity, as they only need to provide their BVN number.

In addition to being used to verify customer identity, BVN code checks can also be used to track down fraudsters and to recover stolen funds. BVN code checks are a valuable tool for banks and other financial institutions in Nigeria, and they have helped to make the Nigerian banking system more secure and efficient.

Biometric linkage

Biometric linkage is the process of linking a person's biometric data to their identity. Biometric data is unique to each individual and can include fingerprints, facial images, iris scans, and voice patterns. BVN code checks rely on biometric linkage to verify the identity of customers. When a customer opens a new bank account, they are required to provide their BVN and biometric data. The bank will then compare the customer's biometric data to the biometric data that is stored in the central database. If the two sets of biometric data match, then the customer's identity is verified.

Biometric linkage is an important component of BVN code checks because it helps to prevent fraud and identity theft. Fraudsters cannot easily replicate a person's biometric data, which makes it difficult for them to impersonate customers and open fraudulent accounts. Biometric linkage also makes it easier for banks to track down fraudsters and recover stolen funds.

BVN code checks are a valuable tool for banks and other financial institutions in Nigeria. They help to prevent fraud and identity theft, and they make it easier for banks to track down fraudsters and recover stolen funds. Biometric linkage is an important component of BVN code checks, and it plays a vital role in making the Nigerian banking system more secure and efficient.

Government agency use

The Bank Verification Number (BVN) is a unique 11-digit number that is used to verify the identity of bank customers in Nigeria. It was introduced by the Central Bank of Nigeria (CBN) in 2014 as part of a drive to reduce fraud and improve the security of the Nigerian banking system. In addition to its use in the banking sector, the BVN is also used by other government agencies, such as the Nigerian Immigration Service and the Federal Road Safety Corps. This helps to ensure that the BVN is a truly unique identifier for all Nigerians.

Identity verificationOne of the most important uses of the BVN by government agencies is for identity verification. The BVN is linked to a customer's biometric data, such as their fingerprints and facial image. This makes it very difficult for fraudsters to impersonate customers or to create fake identities. Government agencies can use the BVN to verify the identity of individuals when they are applying for passports, driver's licenses, or other government services.

Crime preventionThe BVN can also be used by government agencies to prevent crime. For example, the Nigerian Immigration Service can use the BVN to track down individuals who are using fake passports or who are wanted for crimes. The Federal Road Safety Corps can use the BVN to track down drivers who are wanted for traffic violations.

National securityThe BVN can also be used by government agencies to protect national security. For example, the Nigerian Immigration Service can use the BVN to track down individuals who are suspected of being terrorists or who are wanted for other crimes against the state.

Revenue collectionThe BVN can also be used by government agencies to collect revenue. For example, the Federal Inland Revenue Service (FIRS) can use the BVN to track down individuals who are evading taxes.

The BVN is a valuable tool for government agencies in Nigeria. It can be used to verify identity, prevent crime, protect national security, and collect revenue. The BVN is a key part of the Nigerian government's efforts to improve security and efficiency.

FAQs about BVN Code Check

BVN code check, a crucial process in Nigeria's banking system, verifies the identity of bank customers using their unique 11-digit Bank Verification Number (BVN). It plays a vital role in combating fraud and enhancing security. In this FAQ section, we address common questions and misconceptions surrounding BVN code checks.

Question 1: What exactly is a BVN code check?

A BVN code check compares the BVN provided by a customer with the BVN linked to their biometric data stored in the central database. This process confirms the customer's identity and helps prevent fraud and unauthorized access to accounts.

Question 2: Why is a BVN code check important?

BVN code checks are critical in preventing fraud, identity theft, and unauthorized transactions. They ensure that only the rightful account holders can access and operate their accounts, minimizing the risk of financial loss and identity compromise.

Question 3: When is a BVN code check required?

BVN code checks are typically required when opening new bank accounts, applying for loans, making large transactions, or accessing other banking services where identity verification is essential.

Question 4: How do I get my BVN code?

To obtain your BVN, visit any branch of your bank and complete the BVN enrollment form. You will be required to provide your biometric information and a valid means of identification.

Question 5: Can I use my BVN code for other purposes besides banking?

Yes, your BVN can also be used for identity verification by government agencies such as the Nigerian Immigration Service, Federal Road Safety Corps, and other authorized institutions.

Question 6: Is it safe to share my BVN code with others?

It is strongly advised not to share your BVN code with anyone, as it is a highly sensitive piece of information. Sharing your BVN code with unauthorized individuals could compromise your account security and lead to fraudulent activities.

In conclusion, BVN code checks are essential for maintaining the security and integrity of the Nigerian banking system. By verifying the identity of customers, BVN code checks help prevent fraud, protect against unauthorized access, and ensure that only legitimate account holders can conduct financial transactions.

For any further inquiries or assistance with BVN code checks, please contact your bank or visit the official website of the Central Bank of Nigeria.

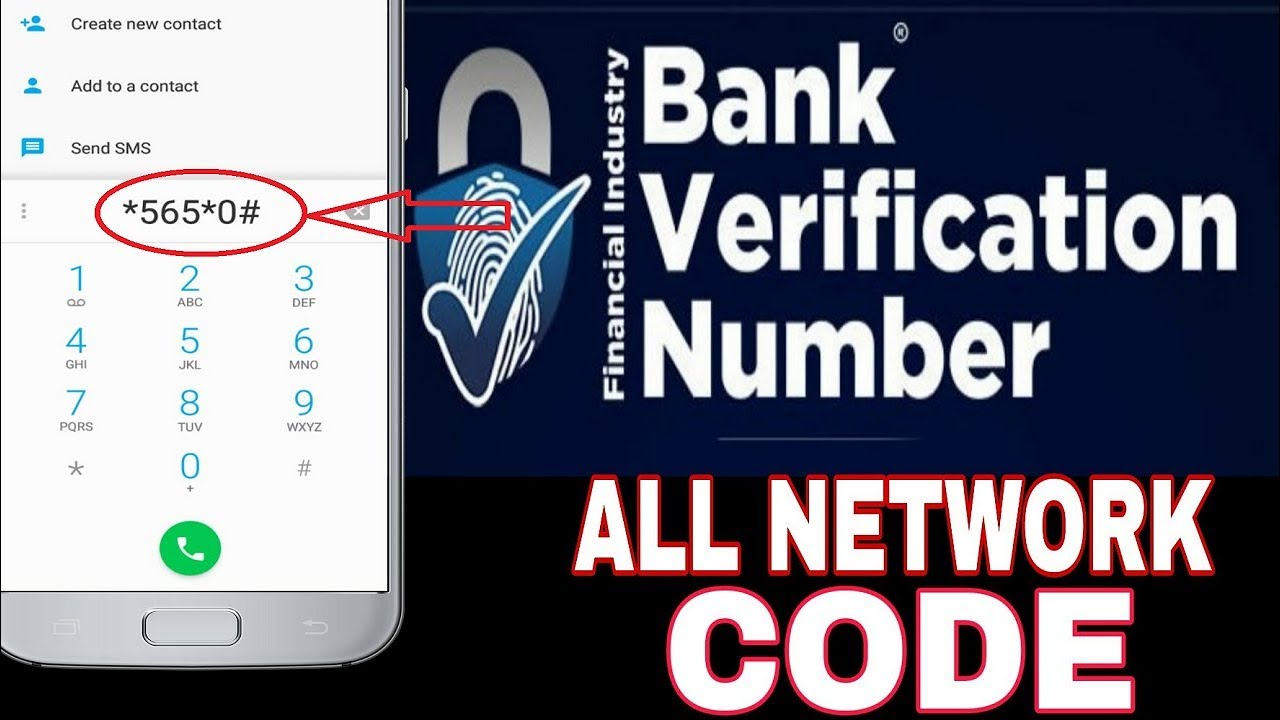

BVN Code Check Tips

BVN code checks are an essential part of banking in Nigeria, helping to prevent fraud and protect your financial information. Here are some tips to help you get the most out of your BVN code check:

Tip 1: Keep your BVN code confidential.Your BVN code is like your PIN number. Never share it with anyone, not even bank staff. If someone asks for your BVN code, it's a scam.Tip 2: Check your BVN code regularly.

You can check your BVN code by sending a text message to 56568. This will help you to ensure that your BVN code is still active and that it hasn't been compromised.Tip 3: Report any unauthorized BVN code checks.

If you receive a notification about a BVN code check that you didn't initiate, report it to your bank immediately. This could be a sign that someone is trying to access your account without your permission.Tip 4: Use strong passwords and PINs.

In addition to protecting your BVN code, you should also use strong passwords and PINs for your bank accounts. This will make it more difficult for fraudsters to access your accounts, even if they have your BVN code.Tip 5: Be aware of phishing scams.

Phishing scams are emails or text messages that look like they're from your bank, but are actually from fraudsters. These scams often try to trick you into giving up your BVN code or other personal information. Never click on links in emails or text messages from unknown senders.By following these tips, you can help to protect yourself from fraud and keep your financial information safe.

BVN code checks are an important part of banking in Nigeria. By following these tips, you can help to protect yourself from fraud and keep your financial information safe.

BVN Code Check

The Bank Verification Number (BVN) code check is a crucial security measure implemented by the Central Bank of Nigeria to safeguard the integrity of the financial system and protect bank customers from fraud. This unique 11-digit number, linked to an individual's biometric data, has revolutionized identity verification and transaction authorization processes.

BVN code checks play a pivotal role in combating financial crimes, such as identity theft, unauthorized access to accounts, and fraudulent transactions. By verifying the identity of customers, banks and other financial institutions can significantly reduce the risk of financial losses and protect the hard-earned money of citizens. Furthermore, BVN code checks facilitate seamless and secure banking operations, fostering trust and confidence in the financial system.

As technology continues to advance and the financial landscape evolves, the BVN code check will undoubtedly remain a cornerstone of financial security in Nigeria. Its effectiveness in preventing fraud and protecting customer information underscores its critical importance. By embracing this innovative measure, banks and customers alike can contribute to a safer and more secure financial ecosystem for all.

Closing A Chapter In Your Life Quotes

Images Of Hump Day Quotes

Symbol Of Black Crow

how to check bvn on uba

How to Register and Get Your BVN Number In Nigeria In 2024

How To Check Your BVN Steps To Follow