Access bank code, a unique identifier assigned to banks, plays a pivotal role in facilitating seamless financial transactions.

The access bank code, a crucial component of the global banking system, ensures the secure and efficient transfer of funds between financial institutions. Each bank is assigned a unique code, enabling precise identification and routing of transactions.

The access bank code holds immense significance, particularly in international transactions, as it helps banks swiftly and accurately identify the beneficiary institution. This code not only streamlines the transfer process but also enhances the security of financial transactions, minimizing the risk of errors or fraudulent activities.

Furthermore, the access bank code simplifies the process of electronic fund transfers, allowing individuals and businesses to conveniently manage their finances. This code underpins the smooth functioning of online banking, mobile payments, and other digital financial services, contributing to the efficiency and accessibility of financial transactions in today's digital age.

access bank code

The access bank code, a vital component of the modern banking system, encompasses several key aspects that contribute to its significance and functionality:

- Unique Identifier: Each bank is assigned a unique access bank code, enabling precise identification and differentiation.

- Transaction Routing: The code facilitates the efficient routing of financial transactions between banks, ensuring timely and accurate delivery.

- International Transactions: In cross-border transactions, the access bank code plays a crucial role in identifying the beneficiary institution, streamlining the transfer process.

- Electronic Fund Transfers: The code underpins electronic fund transfers, enabling convenient and secure online banking and mobile payment services.

- Security: The access bank code enhances the security of financial transactions by minimizing errors and reducing the risk of fraud.

- Global Standardization: Access bank codes adhere to international standards, ensuring compatibility and interoperability between banks worldwide.

- Regulatory Compliance: Banks are required to adhere to regulations governing the use of access bank codes, ensuring transparency and accountability.

- Customer Convenience: By simplifying the process of financial transactions, access bank codes contribute to customer convenience and satisfaction.

In summary, the access bank code serves as a critical infrastructure within the banking system. It facilitates secure, efficient, and seamless financial transactions, both domestically and internationally. The unique identification, transaction routing, and security features of access bank codes underpin the smooth functioning of modern banking operations, enabling individuals and businesses to manage their finances effectively.

Unique Identifier

The access bank code serves as a unique identifier for each bank, enabling precise identification and differentiation within the global banking system. This unique code plays a vital role in ensuring the smooth and efficient routing of financial transactions between banks.

- Global Identification: The access bank code provides a standardized method of identifying banks worldwide. Each bank is assigned a unique code, regardless of its location or size, facilitating seamless cross-border transactions.

- Accurate Routing: The access bank code enables accurate and efficient routing of financial transactions. When a transaction is initiated, the code helps identify the beneficiary bank, ensuring that funds are transferred to the correct institution.

- Reduced Errors: The unique nature of access bank codes minimizes the risk of errors in financial transactions. By precisely identifying the recipient bank, it reduces the likelihood of funds being misdirected or delayed.

- Enhanced Security: The access bank code contributes to the security of financial transactions. It helps prevent fraud and unauthorized access to funds by ensuring that transactions are routed through the correct channels.

In summary, the unique identifier aspect of the access bank code is essential for the smooth functioning of the global banking system. It enables precise identification, accurate routing, reduced errors, and enhanced security, underpinning the trust and reliability of financial transactions.

Transaction Routing

The access bank code plays a pivotal role in transaction routing, ensuring that financial transactions are processed and delivered accurately and efficiently. It acts as a unique identifier for each bank, enabling the swift and secure transfer of funds between financial institutions.

- Precise Routing: The access bank code ensures precise routing of transactions by directing them to the correct beneficiary bank. This minimizes the risk of delays or errors, ensuring timely delivery of funds.

- Global Interoperability: Access bank codes adhere to international standards, enabling seamless routing of transactions across borders. This facilitates efficient cross-border payments and reduces the complexities associated with international fund transfers.

- Reduced Transaction Time: By streamlining the transaction routing process, access bank codes help reduce the time taken for funds to be transferred between banks. This enhances the efficiency of financial transactions and improves customer satisfaction.

- Enhanced Security: The access bank code contributes to the security of financial transactions by preventing unauthorized access to funds. It helps ensure that transactions are routed through legitimate channels, reducing the risk of fraud and cybercrimes.

In summary, the access bank code is essential for efficient transaction routing. It enables precise routing, global interoperability, reduced transaction time, and enhanced security, underpinning the smooth functioning of the global banking system and facilitating the seamless transfer of funds.

International Transactions

The access bank code is an essential component of international transactions, serving as a critical identifier for banks worldwide. In cross-border payments, the access bank code enables the swift and secure transfer of funds by accurately routing transactions to the correct beneficiary institution.

When an international transaction is initiated, the access bank code helps identify the beneficiary bank, ensuring that funds are directed to the intended recipient. This unique code facilitates seamless cross-border payments, reducing delays and minimizing the risk of errors. By streamlining the transaction process, the access bank code enhances the efficiency and reliability of international fund transfers.

Furthermore, the access bank code plays a vital role in adhering to international regulations governing cross-border transactions. It helps ensure compliance with anti-money laundering and counter-terrorism financing measures, contributing to the security and integrity of the global financial system.

In summary, the access bank code is indispensable for international transactions, enabling the smooth and secure transfer of funds across borders. Its role in identifying beneficiary institutions, streamlining the transaction process, and ensuring regulatory compliance underscores its importance as a key component of the global banking system.

Electronic Fund Transfers

The access bank code is the cornerstone of electronic fund transfers (EFTs), enabling seamless and secure transactions through online banking and mobile payment services.

- Secure Transactions:

The access bank code plays a vital role in ensuring the security of EFTs. It helps prevent unauthorized access to funds and protects against fraud by authenticating transactions and ensuring that funds are transferred only to the intended recipient.

- Efficient Processing:

The access bank code streamlines the EFT process, facilitating efficient and timely transfer of funds. It enables banks to quickly and accurately identify the recipient bank, reducing processing time and minimizing delays.

- Global Interoperability:

The access bank code adheres to international standards, enabling seamless EFTs across borders. It allows banks to easily identify and connect with each other, facilitating cross-border payments and remittances.

- Convenience and Accessibility:

The access bank code underpins the convenience and accessibility of EFTs. It enables individuals and businesses to easily initiate and receive payments through online banking and mobile payment services, regardless of their location or time constraints.

In conclusion, the access bank code is essential for EFTs, providing a secure, efficient, and globally interoperable platform for online banking and mobile payment services. It drives financial inclusion by increasing access to financial services and empowering individuals and businesses.

Security

In the realm of financial transactions, security remains paramount. The access bank code plays a pivotal role in safeguarding financial transactions, ensuring the integrity and confidentiality of sensitive financial data.

- Unique Identification:

Each bank is assigned a unique access bank code, serving as a distinctive identifier in the global banking network. This unique code prevents confusion and ensures that transactions are routed to the intended recipient, minimizing the risk of errors.

- Secure Authentication:

The access bank code acts as a secure authentication mechanism, safeguarding transactions from unauthorized access. It ensures that only authorized parties can initiate and approve financial transactions, reducing the risk of fraud and malicious activities.

- Error Prevention:

By providing a standardized and accurate method of identifying banks, the access bank code helps prevent errors in transaction processing. It reduces the likelihood of funds being misdirected or lost due to incorrect routing, enhancing the reliability of financial transactions.

- Compliance with Regulations:

The access bank code aligns with industry regulations and standards, ensuring compliance with anti-money laundering and counter-terrorism financing measures. This adherence to regulations contributes to the integrity and stability of the global financial system.

In conclusion, the access bank code serves as a robust security mechanism in the financial industry. Its unique identification, secure authentication, error prevention, and regulatory compliance features bolster the security of financial transactions, protecting individuals, businesses, and the financial ecosystem at large.

Global Standardization

The global standardization of access bank codes is a cornerstone of the modern banking system, enabling seamless and efficient financial transactions across borders. By adhering to international standards, access bank codes facilitate the interoperability and compatibility of banks worldwide.

This standardization plays a pivotal role in international trade and commerce, where cross-border payments are essential. It eliminates the need for complex and time-consuming manual processes, reducing the risk of errors and delays. The standardized format of access bank codes enables swift and accurate routing of transactions, ensuring that funds are transferred to the intended recipients without complications.

Furthermore, global standardization enhances the security of financial transactions. By adhering to common protocols and formats, banks can effectively combat fraud and cybercrimes. Standardized access bank codes make it easier to identify and track suspicious transactions, reducing the risk of financial losses for individuals and businesses.

In conclusion, the global standardization of access bank codes is a critical component of the modern banking system. It underpins the seamless and secure transfer of funds across borders, promotes interoperability and compatibility between banks worldwide, and strengthens the security of financial transactions.

Regulatory Compliance

The access bank code is closely intertwined with regulatory compliance, as banks are obligated to adhere to regulations governing its use. This compliance ensures transparency and accountability in financial transactions, fostering trust and integrity within the banking system.

- Standardized Transactions:

Regulatory compliance mandates the use of standardized access bank codes, ensuring consistent and accurate transaction processing. This standardization reduces errors, minimizes fraud, and facilitates seamless interoperability between banks.

- Anti-Money Laundering and Counter-Terrorism Financing:

Access bank codes play a crucial role in combating money laundering and terrorist financing. Regulations require banks to verify and authenticate the identities of customers and monitor transactions for suspicious activities. Access bank codes aid in this process by providing a unique identifier for each bank, enabling effective tracking and investigation.

- Data Protection and Privacy:

Regulatory compliance mandates the protection of sensitive financial data. Access bank codes contribute to data privacy by ensuring that transactions are routed through secure channels and that customer information is handled confidentially.

- Consumer Protection:

Regulations safeguard consumer rights and interests in financial transactions. Access bank codes facilitate transparency by providing a clear and verifiable record of transactions, empowering customers to monitor their accounts and identify any unauthorized activities.

In conclusion, the regulatory compliance governing access bank codes is a vital aspect of the banking system. It ensures transparency, accountability, and adherence to ethical and legal standards. By adhering to these regulations, banks foster trust, protect consumers, and maintain the integrity of financial transactions.

Customer Convenience

Access bank codes play a pivotal role in enhancing customer convenience and satisfaction by simplifying and streamlining financial transactions.

- Seamless Transactions:

Access bank codes enable seamless and efficient transfer of funds, both domestically and internationally. The standardized format and global interoperability of these codes ensure that transactions are processed quickly and accurately, reducing delays and frustrations for customers.

- Simplified Fund Management:

Access bank codes empower customers with greater control over their finances. By simplifying the process of sending and receiving payments, customers can easily manage their accounts, track their transactions, and make informed financial decisions.

- Enhanced Accessibility:

Access bank codes contribute to financial inclusion by making banking services more accessible to a broader population. Through online and mobile banking platforms, customers can conduct financial transactions conveniently from anywhere, at any time.

- Reduced Costs:

The use of access bank codes often reduces transaction costs for customers, particularly in the case of cross-border payments. By eliminating the need for intermediaries and manual processing, banks can offer more competitive exchange rates and lower fees.

In conclusion, access bank codes are a cornerstone of customer convenience in the banking sector. Their ability to simplify transactions, enhance accessibility, and reduce costs contributes to overall customer satisfaction and financial well-being.

FAQs on Access Bank Code

This section addresses frequently asked questions and clarifies common misconceptions regarding access bank codes, ensuring a comprehensive understanding of their significance and usage.

Question 1: What is an access bank code?

An access bank code, also known as a bank identifier code (BIC), is a unique identifier assigned to each bank. It facilitates the secure and efficient routing of financial transactions between banks worldwide.

Question 2: What is the purpose of an access bank code?

The primary purpose of an access bank code is to ensure accurate and timely transfer of funds between financial institutions. It helps identify the beneficiary bank, enabling seamless processing and delivery of transactions.

Question 3: Is an access bank code the same as an IBAN?

No, an access bank code is distinct from an IBAN (International Bank Account Number). While both are used in international transactions, an access bank code identifies the bank, and an IBAN identifies the specific account within that bank.

Question 4: How can I find the access bank code for my bank?

You can typically find your bank's access bank code on bank statements, online banking platforms, or by contacting your bank directly.

Question 5: Are access bank codes used for all types of financial transactions?

Yes, access bank codes are used for various types of financial transactions, including domestic and international wire transfers, electronic fund transfers (EFTs), and cross-border payments.

Question 6: Is it safe to share my access bank code?

Sharing your access bank code is generally not recommended, as it could potentially compromise the security of your financial transactions. Only disclose your access bank code to trusted parties or financial institutions when necessary.

In summary, access bank codes play a vital role in facilitating secure and efficient financial transactions globally. Understanding their purpose and usage is crucial for seamless and reliable banking.

Transition to the next article section...

Tips for Using Access Bank Codes

Access bank codes are essential for secure and efficient financial transactions. Here are some tips to ensure their effective use:

Tip 1: Confirm the Correct Code

Always verify the access bank code before initiating a transaction. Ensure that the code matches the intended recipient bank to avoid errors and delays.

Tip 2: Protect Your Code

Treat your access bank code as confidential information. Avoid sharing it with unauthorized individuals or websites to safeguard your financial security.

Tip 3: Use Trusted Channels

When sharing your access bank code, only do so through secure and trusted channels, such as official bank websites or mobile banking apps.

Tip 4: Be Aware of Fraud

Be cautious of requests for your access bank code via email or phone. Legitimate financial institutions will never ask for this information through unsecured channels.

Tip 5: Keep Records

Maintain a record of all your financial transactions, including the access bank codes used. This can help you track your transactions and identify any discrepancies.

Tip 6: Contact Your Bank for Assistance

If you encounter any issues or have questions regarding access bank codes, do not hesitate to contact your bank. They can provide you with guidance and support.

By following these tips, you can ensure the secure and efficient use of access bank codes for your financial transactions.

Summary: Access bank codes are crucial for seamless financial transactions. By adhering to these tips, you can safeguard your financial information, prevent errors, and optimize your banking experience.

Transition to the conclusion of the article...

Conclusion

Access bank codes have emerged as indispensable tools in the modern financial landscape, underpinning the secure, efficient, and seamless transfer of funds worldwide. Their unique identification, transaction routing, and security features have revolutionized banking operations, enabling individuals and businesses to conduct financial transactions with confidence and convenience.

As the global economy continues to evolve, access bank codes will undoubtedly play an increasingly pivotal role. Their standardization and interoperability will facilitate even greater cross-border trade and financial integration. Moreover, advancements in technology, such as blockchain and artificial intelligence, promise to further enhance the efficiency and security of access bank codes.

In conclusion, the access bank code has proven to be a transformative tool that has revolutionized the way we send and receive money. Its significance will only continue to grow as we move towards a more interconnected and digital financial future.

Jack Quaid Net Worth

Tv Shows With Carmen Villalobos

Stephen Deleonardis Age

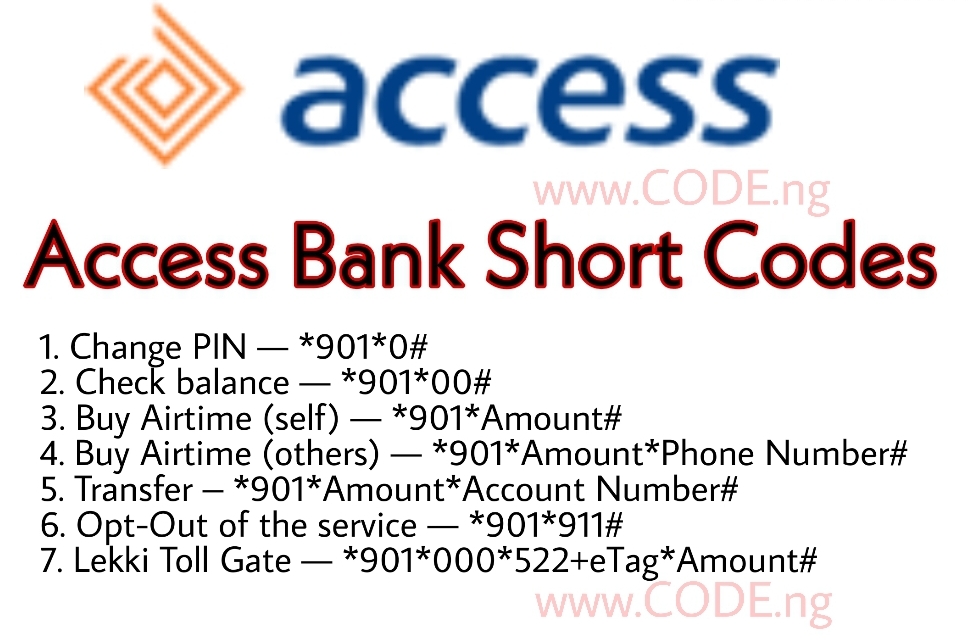

Access Bank USSD Codes for all mobile transactions in Nigeria Things

Access Bank USSD Code for Transfer, Airtime & Balance — *901

Access Bank USSD *901 pin code How to register and transfer money